In continuation to our efforts in improving usability, increasing engagement, increasing collection, reducing the operational efforts, and supporting acquisition and retention in the system, we have identified and rectified the following product gaps and added certain valuable enhancements to the product.

Security

- Right to be Forgotten Approval

Since GPPR has been rolled out to our societies, multiple users exercise their right to be forgotten from the MyGate Platform. The users reach out to us via the ‘Right to be Forgotten’ option in the app and request us to delete their details from the platform. The admins are required to approve the request before deletion by the Data Protection Officer. Currently, this process was manually done via emails. We have enabled the admins to approve/reject the requests through our dashboard for better visibility and logs.

People Hub >> Residents >> GDPR Deletion Requests

- Mobile number search field in the Service Providers List

Another search field in the service providers listing page has been added through which the admins can search using the mobile number for easier fetching of data. This will help the admins to search the service provider details with the mobile number in case the name or passcode is unavailable.

People Hub >> Service Providers >> Service Providers List

- Bulk Deletion of Vehicles

The admins did not have an option to bulk delete vehicles and this was causing difficulty in large societies as admins had to delete them one by one. The admins can now enter the details in the sample format provided and upload the same to delete multiple vehicles at the same time.

Society >> Parking >> Vehicle List >> Bulk Deletion >> Enter the details in the sample format >> Upload >> Submit

ERP

- One-click TDS Payment to Government

Record TDS payments made to govt under the taxable report section. Now the accountants/admin users can not only view the TDS payable to govt but also select the individual TDS entries and make payment against those transactions. This will help the user to build more visibility on the paid and unpaid entries.

Dashboard >> Financial Reports >> Tax Reports >> TDS Payable Report

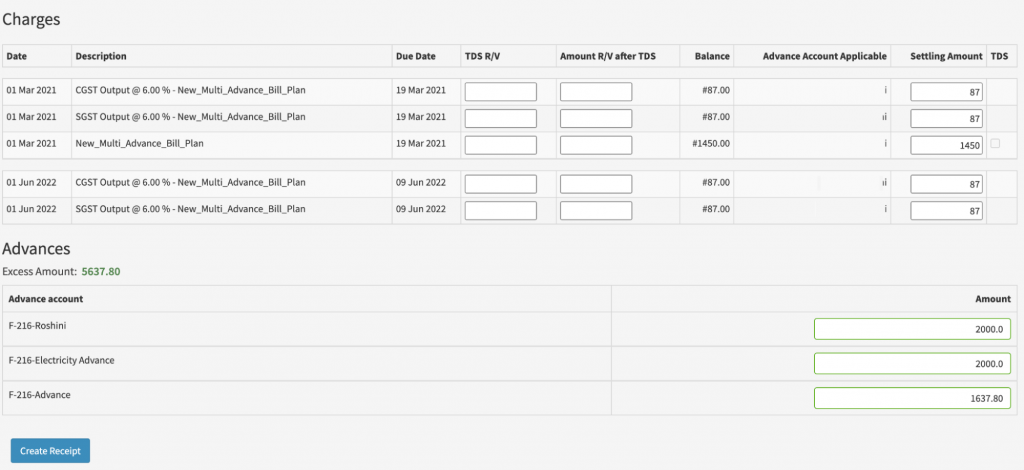

- Multiple Bill Plans – Handling Excess Payment

While booking a receipt amount more than the dues amount, the admin/Accountant should have an option to allocate the excess value in advance ledgers of his/her choice. To meet this, we have introduced excess amount reporting and allocation space below the settlement table and via dropdown selection and input value.

Dashboard >> Accounts >> Dues and Receipts >> Dues >> House Dues >> Receipt Form

In case of multiple advances –

- Inventory Report v2.0

- New report table with relevant filters to track stock updates/usages transparently

- New table in print and download

- New filters introduced – Stock Name/ID, Custodian/Staff & Location/Asset

Assets & Inventories >> Inventory >> Reports

- Conversion of accumulated penalty to ledger entry on demand

To address the following admin difficulties –

- Booking the accumulated penalty within the FY of its generation to ease auditing

- Transfer of accumulated penalty on a monthly basis to Tally

This new advanced action would enable the admin to convert the provisional penalties until the date of his choice to be replaced by an actual aggregated penalty invoice of the same value. This booked income can then be used for auditing or transfer.

The batch of penalty invoices generated would have the marker of ‘Converted’ in its title along with the name of the bill plan it is generated for. Deleting these batches would revert the conversion applied to the accumulated penalties.

Dashboard >> Accounts >> Dues and Receipts >> Dues

Account statement view:

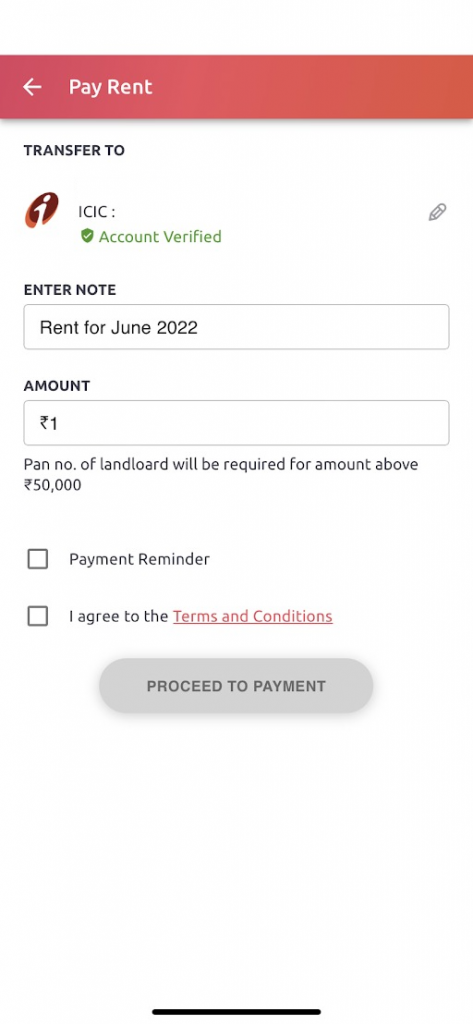

- Beneficiary Account verification for Rent Pay & Society Charges

Enhancing the user experience and avoiding any failure in any payment. We have brought in a validation where the beneficiary account (Landlord’s/Society’s Bank Account) would be added and a penny drop test would be done to check the authenticity of the account. This will help the user cross-verify the account before going ahead with payment.

App Home Page >> Rent Pay >> Landlord details >> Checkout

- Search implementation in filters

Reducing the daily burden on Accountant and Admin users doing multiple scrolls, we have added search boxes in the filter options under Assets, Inventory, Add Asset, Add inventory, Create a Purchase request and Create a request for quotation, implementing it in 30 + locations.

Assets & Inventories >> Inventory >> Reports

- Vendors – Filter and Pagination

With the new search functionality on the vendor page, now an Admin/Accountant can fetch the details much faster and avoid multiple scrolls. Also, the number of vendors displayed on a page has been limited to 20, enabling faster loading time and easier viewing.

People Hub >> Vendors

- Mumbai Penalty – GST will now be associated with the penalty principal

This update is applicable for societies where GST on the Mumbai Penalty system is enabled. The system, traditionally, has not strictly associated the GST value to its penalty principal – resulting in the application of a fresh penalty on subsequent invoices for the unpaid GST. With the improvement, now new penalty will not be charged on that unpaid GST unless the software is specifically configured to compound over penalties.

- Flow changes to New Penalty automatic generation

To handle the following cases –

- Need for separation of generated penalty invoices belonging to various bill plans to manage dues and sequencing

- Need for mention of ‘Tax Invoice’ if GST is enabled on penalty to meet compliance

When a resident makes a payment against his/her accumulated penalties under multiple plans, the system would segregate the generated penalty invoice into corresponding parts. A new naming convention for the title of such invoices is also introduced.

- GST Output Report – Total and GST Rate Columns

To bring more usage readiness to the report, we have added two new columns – total amount and GST rate. The total amount column sums the GST and the taxable amount while the rate column is especially helpful with varying output rates in the case of non-members.

Financial Reports >> Tax Reports >> GST output Report

- Dues Page – Security Deposit Summary

The total security deposit collected in the society is now available as a summary on the new dues page.

Accounts >> Due and Receipts >> Dues

- Handling Penalty in FD

Previously when the penalty was applied on premature FD, the additional JE entries for it were not associated with the principal transaction. With the current update, we have made the necessary changes under the FD section enabling the journal entries to be shown under General Ledger while applying a penalty over Premature FD.

Additional Notes :

Meter Edit to allow details reset

- Edit meter number should allow the details to be reset.

- DB for the first house will be replaced with blank, allowing correction in the second meter.

Format Issue in Dues Report Download

- The excel file name now contains the name of the report

- The first two rows summarize the society and period information

- Formatting should be changed to number for value cells