What is a co-operative society? It is not just a way of living, or functioning of a building or complex. A co-operative society can be quite a profit-making entity too. The main objective of this entity is to acquire marketability for products. It was in 2002 that the Multi-State Co-operative Societies Act was passed, which allowed a Co-operative society to function in an autonomic and democratic way. To know what a co-operative society means, let us try to understand the need and formation better.

What is a co-operative society?

The co-operative society definition essentially states, ‘It is an association of individuals who voluntarily get together to work as a unit to promote a common economic interest’. These types of societies, in other words, function on the concept of ‘Self-Help’ and ‘Mutual Help’. The primary goal of a Co-operative Society is for members to contribute economically together and support each other. Furthermore, nobody must leave a co-operative society without making a profit from it. In other words, a harmonious society is formed to promote self-help. A co-operative society in India is usually governed by the Co-operative Societies Act of various states or by the Multi-State Co-operative Societies Act, 2002.

Key features of co-operative societies

There are a few essential features of co-operative societies:

- They stimulate the promotion of a co-operative movement in society.

- Encourages a feeling of cooperation for mutual benefits among people in society.

- Enhances the creation of services not for profit.

- It helps develop cooperation between people and eliminates competition.

- It also ensures people learn to depend more on themselves and not on others.

Eligibility criteria for a co-operative society

There are specific eligibility criteria that an individual needs to fulfil to become a co-operative society member. As per the state Act, the rules needed to become a part of a harmonious society are:

- An individual of 18 years and above looking to be a part of a co-operative must be of sound mind.

- The individual must belong to the co-operative society formed per the Co-operative Societies Act.

- The individual must not be a defaulter of another registered co-operative society.

- Managing committee’s approval of the membership application submitted by the individual is a must.

Co-operative society examples

It is essential for all who wish to become co-operative society members per the Co-operative Societies Act, 1912. Here are a few examples of types of Co-operative societies.

- Housing Society

- Producer’s Society

- Agricultural Marketing Society

- Consumer Society

- Co-operative Bank

- Federal Society

How to form a co-operative society?

According to the co-operative society definition, as per the Co-operative Societies Act, 1912, a few steps need to be taken to become a co-operative society member. They are as follows:

- A membership application must be duly filled out and submitted to the Registrar of co-operative societies.

- The application must have attached four copies of the proposed by-laws of the co-operative society.

- All the applicants of a co-operative society must be individuals, and they should be more than ten in number.

- All applicants must sign the application if they are individuals.

- If the applicant is the society, then an authorized member must sign the application.

Laws governing the formation of a co-operative society

A couple of laws govern a Co-operative Society in India, including the following:

- State Co-Operative Societies Act of individual States

- Multi-State Co-Operative Societies Act 2002

Connection between tax and co-operative society

A co-operative society is a separate entity in the Income Tax Act of 1961. Even though it is not mentioned in it, it is in section 80P that there is a connection between tax and Co-operative Society. According to the section, co-operative societies are exempted from benefits. These types of institutions are also assessed as per the Act. Moreover, co-operative societies do not enjoy complete exemption from taxes. They are entitled to a specific deduction from total gross income. As per section 80P, the reduction of taxation of co-operative societies is of two main types. They are as given below:

1. General Deductions

This type of reduction in income tax is available to all members of a co-operative society.

2. Specific Deductions

This form of deduction is available to individuals within a co-operative society.

Types of income that a co-operative society can earn

It is a fact that these days many co-operative societies have started earning by conducting business. It is because, as per co-operative society definition, forming such a society aims to stimulate common economic benefit for all members. The profits and losses are calculated using standard methods such as computation and the ordinary accepted commercial principles. It is also essential that a co-operative society sticks to one approach of maintaining its income through commercial activities.

Therefore, it can either use a cash basis or mercantile basis method. The point to remember is that a co-operative society must adopt either income management style. There are a few types of income that a harmonious society can earn. They are as follows:

- Interest on Securities

- Income from House Property

- Capital Gains Income

- Income from Business

Relation between Income Tax Act and Co-operative Societies

According to Section 2 (19) of the Income Tax Act, “A Co-operative Society means any society registered under the Co-operative Societies Act 2012”. It means that a co-operative society registered with any state in the country is not allowed to function in any other state without permission and sanction of the Government or Registrar of the co-operative societies of that state. It is only a Multi-State Co-operative Society that can work in more than one state as a matter of right. In this case, as per the Act, no permission from any other state is required to do business.

Procedure involved in taxing taxable income for co-operative societies

When it comes to computing taxable income earned by a Co-operative Society in India formed as per the co-operative society definition, a few steps need to be taken. They are:

- Compute the total income by placing it in various categories’ Income from House Property, ‘Capital Gains’, and ‘Income from other sources.

- Then the prescribed income exemptions must be ignored, leaving you with ‘Gross Total Income’.

- The next step involves the application of the deductions mentioned as per the Income Tax Act.

- Finally, added to the ‘Net Income’ earned by a co-operative society is the ‘Rate of Tax’ according to the Finance Act. The amount of tax, per cent of income tax, and cess surcharge applicable is computed following the Finance Act.

Exemptions and deductions under the IT Act that apply to co-operative societies

For a co-operative society involved in business, several exemptions and deductions are made available to them under the IT Act. They are as follows:

1. Exemptions

Exemptions are essentially available for co-operative societies for certain classes of income. Mainly those which are not a part of the total revenue and are exempt from income tax. A few permissible exemptions available for a co-operative society in India are as follows:

- Section 10 A: This includes exemption of profits obtained from a new industry undertaken by a co-operative society in a free trade zone for ten years.

- Section 10 B: This includes exemption of profits acquired from a 100% export-oriented undertaking for ten years.

2. Deductions

Deductions are included for co-operative societies belonging to a particular income category. However, as per the Income Tax Act Chapter VI-A (Section 80A to 80U), filing an income tax return is necessary. Therefore, a few deductions are provided for the following cases given below:

- In calculating the total income of a co-operative society member as specified in Sections 80C to 80U.

- A deduction is made for any amount paid as donations to certain funds as per Section 80G.

- A deduction of 50% of profits from projects initiated outside of India as stated in Section 80HHB.

- A deduction of the entire profit from income generated from export business as mentioned in Section 80HHC.

Advantages of a co-operative society

As per the co-operative society meaning, there will be a few pros and cons to creating it. However, a few Advantages of Co-operative Society are as follows:

- Forming a co-operative society is not difficult.

- There are no restrictions on memberships in a co-operative society.

- The daily management of a co-operative society is democratic.

- The cost of operating a co-operative society is affordable.

- Income Tax exemption is available for a co-operative society.

A few co-operative society examples in India include the Indian Farmers Fertilizers Co-operative Limited, Amul, Indian Coffee House, Pratibha Mahila Sahakari Bank etc.

Conclusion

There are benefits of having a co-operative society for your business model, provided the right rules and regulations are followed. The formation, execution, and running of a co-operative society are facilitated by the government for better growth and fair opportunities.

A rental agreement has important terms and conditions mutually accepted by the tenant and landlord. The registration of a rental agreement is important for it to be legal and valid. With growing tenancy disputes, it is vital to draft a comprehensive rental agreement and register it at the nearest sub-registrar’s office.

Many times, landlords and tenants skip registering rental agreements, sometimes to avoid the registered rent agreement cost and sometimes to save time. In these cases, things are settled verbally, or if a rent agreement is made, it is never registered and is not legally a valid document.

What is a rental agreement?

A rental agreement is a contract signed between a landlord and a tenant stating that the tenant can occupy the landlord’s residential premises for a certain time. It is a detailed document to avoid future disputes on a property, rent, maintenance, and other factors.

What is a registered rent agreement?

When a rent agreement is stamped by the sub-registrar’s office, online or offline, it is considered registered. This is the only way for your rent agreemental to be legal and valid.

Why is a rental agreement important?

For a dispute-free relationship between a landlord and a tenant, it is vital to have a rental agreement, as it protects the rights of both parties. A rental agreement has details like rent, who owns the property, rent agreed upon, the condition of the property (which is how it should remain when the tenant leaves), items belonging to the landlord that the tenant has to leave behind, and much more. A registered rent agreement is an authentic document that can be presented in a court of law in case of a dispute.

When to register a rental agreement?

While it is not mandatory to register a rental agreement for less than one year, it is in everyone’s interest to have them registered. It may be time-consuming, but it assures a better resolution in times of conflict.

Except for Jammu and Kashmir, the Registration Act of 1908 applies to all states. According to the act, a ‘lease’ includes commercial property, residential property, undertakings leased for cultivation, hereditary allowances, fisheries, ferries, rights to ways, lights, and any other benefit arising from the land (excluding timber or crop cultivation).

How to register a rent agreement?

Rental agreements are registered at the sub-registrar’s office. The registration and expiration dates should be at least four months apart.

To register the rental agreement, both the parties – the tenant and the property owner – should sign the documents in the presence of two witnesses and pay the fee. If either of the parties is not present at the time, they must sign the Power of Attorney, granting the attorney the rights of agreement closure.

What is the format of a rental agreement?

Here is a basic format of an 11-month rent agreement.

Rent Agreement

This rent agreement is made on this _ (date) by _______ (name of the landlord) S/o ___ (father’s name of the landlord), Address: _______________________________________ (residential address of the landlord). Hereinafter called the Lessor/Owner, and first party

AND

_________________ (Name of tenant), called lessee/tenant, or second party

The expression Lessor/Owner and the Lessee/Tenant shall mean and include their legal heirs successors, assigns, representatives etc.

Whereas the first party is the owner and in possession of the property No: ___________________________________________________________________________________ (address of rented property) and has agreed to let out the said property to the second party for a monthly rent of Rs. /- (in words) per month.

Now This Rent Agreement Witness As Under:

That the second party will have to pay Rs. /- (in words) as monthly rent, which does not include electricity and water charges.

That the second party shall pay one month’s rent in advance to the landlord that would be further adjusted in the monthly rent.

That the second party shall pay the water and electricity charges on the basis of the consumption to the landlord/owner.

That the second party shall not lease the property to a subtenant under any circumstances without the consent of the owner/landlord.

That the second party shall follow all the rules and regulations, and by-laws set by the local authorities in respect of the leased property and will not get involved or do illegal activities on the leased property.

That this rent agreement is granted for a period of eleven (11) months starting from , and this contract can be extended further with the mutual consent of both parties.

That the second party shall not be permitted to do construction in the rented premises. Besides, he/she could do the installation of temporary decoration, wooden partition/cabin, air conditioners etc. without seeking the permission of the landlord.

That the second party is not allowed to make any alteration to the rented property without the written consent of the owner.

That the second party will have to allow the landlord or his authorised agent to enter into rented premises for its inspection or general checking for any repair work if needed.

That the second party shall keep the premises clean.

That the second party shall bear the cost of day-to-day minor repairs.

That this contract/agreement could be revoked before the expiry of this tenancy period by serving a one-month prior notice.

That both the parties have read and understood this agreement and have agreed to sign the same without any pressure from any side.

In WITNESS WHEREOF

The landlord and the tenant have hereunto subscribed their hand at (place) on this the ______ (date of rent agreement) year first above mentioned in presence of the following witnesses.

Witnesses:

1.

2.

(name of the landlord) ______ (name of the tenant)

Lessor Lessee

Documents required for rent agreement registration

1. Documents by the landlord

- Two passport-sized photos.

- Aadhaar card.

- ID proof (Driving Licence, Aadhaar Card, Voter ID, Passport).

2. Documents by the tenant

- Two passport-sized photos.

- Aadhaar card.

- Voter ID card.

- Passports for people from outside India.

Details required in a rental agreement

A rental agreement should contain the following details:

- Names and addresses of the landlord and the tenant

- Signatures of the tenant and the landlord

- Monthly rental amount

- Security deposit

- Maintenance charges

- Period of stay

- Responsibilities/rights of the landlord

- Responsibilities/rights of the tenant

The registered rent agreement cost

- Stamp duty will vary from state to state. This is the amount paid to buy stamp paper. In Delhi, the stamp duty is two per cent of the average annual rent for a rental agreement for up to five years.

- Some states have an e-stamping facility for rental agreements. Log on to the Stock Holding Corporation of India Ltd (SHCIL) website and check if your state offers this facility. Assam, Uttarakhand, Gujarat, Karnataka, Himachal Pradesh, Maharashtra, Delhi-NCR, Uttar Pradesh and Tamil Nadu allow e-stamping of rent agreements.

How to make a rent agreement online?

Numerous online platforms, like MyGate, offer such services. All one needs to do is to:

- Enter the necessary details (landlord, tenant, property address), terms and conditions (lease duration, monthly rent, security deposit amount, etc.).

- Make a payment of the applicable stamp duty and other charges.

The online rent agreement will be printed on stamp paper of appropriate value and delivered to the relevant address. For a soft copy, one may ask for the online rent agreement to be sent to their email, along with an e-stamp. The rent agreement hard copy delivery time is between three and five working days.

If you have any questions about how to get a rent agreement online, these online platforms have detailed answers to all your queries.

Can an online rental agreement be registered?

The online rent agreement registration is possible in 12 states with their own online registration portals. The landlord has to create a profile at one of these portals, enter all the details, and make payment of the stamp duty and other charges by generating an online challan receipt. During the process, e-signs, photos, thumb impressions, and KYC of both parties are also required.

You can check the registration status by logging into the website and through SMS.

Summary

As India is witnessing a larger population shift to urban areas, a faster and more seamlessly aligned procedure to register rental agreements becomes mandatory. While offline rental agreement registration is the traditional method, online rent agreement registrations have grown in popularity due to their convenience while remaining legal and valid. Choose the method that works for you, but make sure to register your rental agreements.

It is no wonder that Hyderabad ranks among the most sought-after Indian cities to live in. On the one hand, you have a rich cultural heritage that dates back to the Mughal era, replete with awe-inspiring Islamic architecture and traditional cuisine that has its base on recipes that date back a few centuries.

On the other hand, you have an ultra-modern city, poised to be a global leader in technology, choc-a-block with the biggest brands, a melting pot of international cuisine to choose from, and an education system that’s on par with the best in the world, efficient infrastructure and a nightlife that is second to none.

If you’re considering making this city your home or investing in some real estate, we’ve curated a list of six top gated communities in Hyderabad for your perusal.

1. Rainbow Vistas- HiTech City

There are multiple reasons why Rainbow Vistas features on our list of the best gated communities in Hyderabad. The property boasts over 2000 apartments spread over a vast area of 22 acres, making it one of the largest gated community apartments in Hyderabad.

Flanked by two lakes and ample breathing space for residents, the property has 2, 3 and 4-bedroom luxury apartments with a host of amenities. The sizes of the apartments range from 1250 square feet to an uber-spacious 3000 square feet.

The amenities comprise everything from a clubhouse and an air-conditioned gym to a host of indoor and outdoor sports as well as a supermarket, pharmacy, coffee shop, spa, beauty parlour, modern security systems and more, making the property pretty much self-sufficient.

2. My Home Navadweepa- HiTech City

Among the city’s hustle and bustle, My Home Navadweepa offers residents much-needed space and fresh air, making it what many call the best society in Hyderabad to live in. The property features four fabulous high-rise towers that house a select 556 units.

Apartment sizes range from cosy 2-bedroom apartments to more spacious 3-bedroom and 5-bedroom apartments. The price of an apartment here varies between INR 9,000 per square foot to INR 10,000 per square foot.

These homes feature plenty of natural ventilation, premium fittings and top-quality flooring across all rooms. Among the amenities offered to residents are an enormous clubhouse, a cycling and jogging track, a swimming pool, power backup, plenty of garden spaces, ample parking spaces for residents and visitors and round-the-clock security.

Considering the additional benefit of proximity to some of the city’s well-known educational institutions and medical services, it is no wonder that My Home Navadweepa features on our list of the best gated communities in Hyderabad.

3. Divine Allura- Chandanagar

Divine Allura is a gated community apartment complex in Chandanagar spread over 5 acres. It makes our elite list of gated communities in Hyderabad because of its amenities.

Divine Allura has world-class amenities, such as a swimming pool, clubhouse, top-of-the-line security and a creche for toddlers. A few other facilities over here include a children’s play area, ample parking space, a bank with ATM facilities, power backup and much more.

Another endearing feature of this property is that it has eight towers with only five floors each. These towers house 397 2 and 3-bedroom apartments, ranging in size from 1074 square feet to 1722 square feet. The average cost of these apartments is pegged at approximately INR 3,699 per square foot.

4. Elegant Floatilla- Manikonda

Elegant Floatilla in Manikonda has multiple features to make it qualify as one of the top gated communities in Hyderabad.

It is located in a prime locality, on the 80-feet ring road in Manikonda. The property is spread over 4 acres and features only 282 exclusive units. So residents have plenty of green space and do not have to bother about being close to each other. The property boasts six towers, each of which is only five storeys.

The sizes of the luxurious 2 and 3-bedroom apartments in Elegant Floatilla range from a spacious 1300 square feet to a staggering 3240 square feet.

The amenities offered at Elegant Floatilla include a swimming pool with a children’s pool area featuring slides, a gym, an ATM, power backup, ample parking space, RO water systems, indoor and outdoor sports/gaming facilities, a banquet hall, library and more.

5. Aparna Cyberzone- Nallagandla

Aparna Cyberzone is spread across a sprawling 21-acre campus, in which it houses 1350 apartments across 21 towers with 10 storeys each.

The apartments at Aparna Cyberzone are available in 2 and 3-bedroom variations and vary in sizes from 1245 square feet to 1855 square feet. The promoters of this property claim it features a blend of traditional values and modern architecture.

Aparna Cyberzone features enough modern amenities to make it a self-reliant gated community. It has supermarkets, outdoor and indoor play areas, a basketball court, a badminton court, a swimming pool, a community hall and more.

Additionally, Aparna Cyberzone is well-connected with public transport and offers luxurious living at affordable prices, making the property more appealing. Here, the 2-bedroom apartment costs about INR 56 lakh, while the 3-bedroom ones are about INR 90 lakh.

This perfect blend of affordability and opulence is why Aparna Cyberzone features on our list of luxury gated communities in Hyderabad.

6. Hill Ridge Springs- Gachibowli

Located amid Hyderabad’s IT hub, Hill Ridge Springs has been developed by IVR Prime Urban Developers and features 16 towers with 11 floors, each spread over 4 acres of pristine land.

The builders have infused modern architecture with Feng Shui and Vastu principles, which shows in multiple aspects of the property, from how the homes are designed to the thoughtful walkways, rock gardens, water bodies and more.

Residents can choose from 2, 3 and 4-bedroom apartments, the sizes of which range from a comfortable 1100 square feet to a sprawling 3700 square feet.

The list of amenities matches the world-class build quality. It includes a separate service lift for staff and deliveries, professionally maintained gardens, walkways, a swimming pool, outdoor tennis courts, a basketball court, a huge clubhouse and more.

Depending on the size of home you choose and whether you opt for a renovated, redesigned or fully furnished home, expect to spend anywhere between INR 60 lakh to INR 2 crore for an apartment over here.

With its proximity to IT offices, world-class hospitality and entertainment, some of Hyderabad’s best educational institutions and top-notch medical facilities, Hill Ridge Springs in Gachibowli deserves its spot on our list of the best gated communities in Hyderabad.

In continuation to our efforts in improving usability, increasing engagement, increasing collection, reducing the operational efforts, and supporting acquisition and retention in the system, we have identified and rectified the following product gaps and added certain valuable enhancements to the product.

Security

- Right to be Forgotten Approval

Since GPPR has been rolled out to our societies, multiple users exercise their right to be forgotten from the MyGate Platform. The users reach out to us via the ‘Right to be Forgotten’ option in the app and request us to delete their details from the platform. The admins are required to approve the request before deletion by the Data Protection Officer. Currently, this process was manually done via emails. We have enabled the admins to approve/reject the requests through our dashboard for better visibility and logs.

People Hub >> Residents >> GDPR Deletion Requests

- Mobile number search field in the Service Providers List

Another search field in the service providers listing page has been added through which the admins can search using the mobile number for easier fetching of data. This will help the admins to search the service provider details with the mobile number in case the name or passcode is unavailable.

People Hub >> Service Providers >> Service Providers List

- Bulk Deletion of Vehicles

The admins did not have an option to bulk delete vehicles and this was causing difficulty in large societies as admins had to delete them one by one. The admins can now enter the details in the sample format provided and upload the same to delete multiple vehicles at the same time.

Society >> Parking >> Vehicle List >> Bulk Deletion >> Enter the details in the sample format >> Upload >> Submit

ERP

- One-click TDS Payment to Government

Record TDS payments made to govt under the taxable report section. Now the accountants/admin users can not only view the TDS payable to govt but also select the individual TDS entries and make payment against those transactions. This will help the user to build more visibility on the paid and unpaid entries.

Dashboard >> Financial Reports >> Tax Reports >> TDS Payable Report

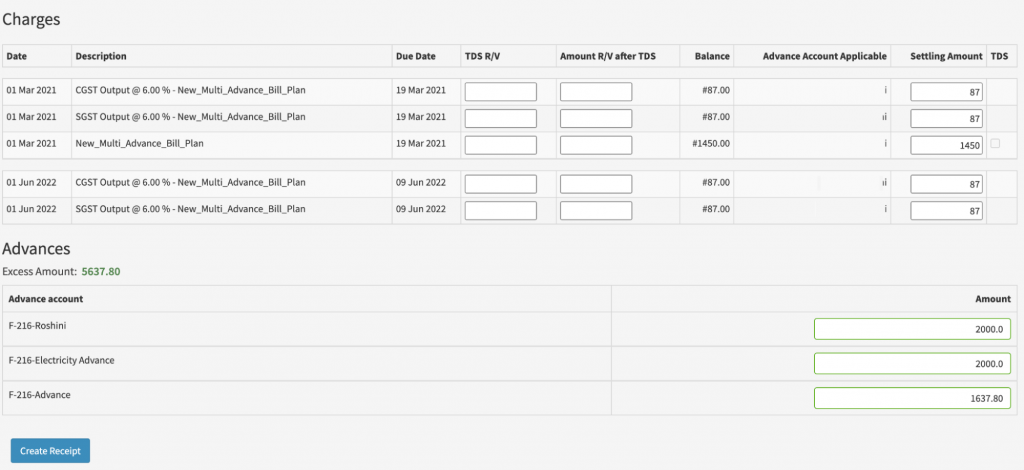

- Multiple Bill Plans – Handling Excess Payment

While booking a receipt amount more than the dues amount, the admin/Accountant should have an option to allocate the excess value in advance ledgers of his/her choice. To meet this, we have introduced excess amount reporting and allocation space below the settlement table and via dropdown selection and input value.

Dashboard >> Accounts >> Dues and Receipts >> Dues >> House Dues >> Receipt Form

In case of multiple advances –

- Inventory Report v2.0

- New report table with relevant filters to track stock updates/usages transparently

- New table in print and download

- New filters introduced – Stock Name/ID, Custodian/Staff & Location/Asset

Assets & Inventories >> Inventory >> Reports

- Conversion of accumulated penalty to ledger entry on demand

To address the following admin difficulties –

- Booking the accumulated penalty within the FY of its generation to ease auditing

- Transfer of accumulated penalty on a monthly basis to Tally

This new advanced action would enable the admin to convert the provisional penalties until the date of his choice to be replaced by an actual aggregated penalty invoice of the same value. This booked income can then be used for auditing or transfer.

The batch of penalty invoices generated would have the marker of ‘Converted’ in its title along with the name of the bill plan it is generated for. Deleting these batches would revert the conversion applied to the accumulated penalties.

Dashboard >> Accounts >> Dues and Receipts >> Dues

Account statement view:

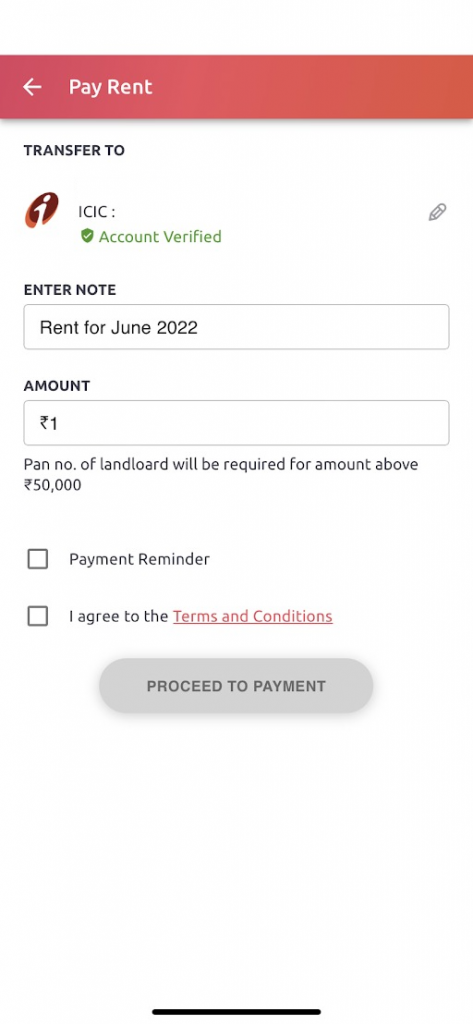

- Beneficiary Account verification for Rent Pay & Society Charges

Enhancing the user experience and avoiding any failure in any payment. We have brought in a validation where the beneficiary account (Landlord’s/Society’s Bank Account) would be added and a penny drop test would be done to check the authenticity of the account. This will help the user cross-verify the account before going ahead with payment.

App Home Page >> Rent Pay >> Landlord details >> Checkout

- Search implementation in filters

Reducing the daily burden on Accountant and Admin users doing multiple scrolls, we have added search boxes in the filter options under Assets, Inventory, Add Asset, Add inventory, Create a Purchase request and Create a request for quotation, implementing it in 30 + locations.

Assets & Inventories >> Inventory >> Reports

- Vendors – Filter and Pagination

With the new search functionality on the vendor page, now an Admin/Accountant can fetch the details much faster and avoid multiple scrolls. Also, the number of vendors displayed on a page has been limited to 20, enabling faster loading time and easier viewing.

People Hub >> Vendors

- Mumbai Penalty – GST will now be associated with the penalty principal

This update is applicable for societies where GST on the Mumbai Penalty system is enabled. The system, traditionally, has not strictly associated the GST value to its penalty principal – resulting in the application of a fresh penalty on subsequent invoices for the unpaid GST. With the improvement, now new penalty will not be charged on that unpaid GST unless the software is specifically configured to compound over penalties.

- Flow changes to New Penalty automatic generation

To handle the following cases –

- Need for separation of generated penalty invoices belonging to various bill plans to manage dues and sequencing

- Need for mention of ‘Tax Invoice’ if GST is enabled on penalty to meet compliance

When a resident makes a payment against his/her accumulated penalties under multiple plans, the system would segregate the generated penalty invoice into corresponding parts. A new naming convention for the title of such invoices is also introduced.

- GST Output Report – Total and GST Rate Columns

To bring more usage readiness to the report, we have added two new columns – total amount and GST rate. The total amount column sums the GST and the taxable amount while the rate column is especially helpful with varying output rates in the case of non-members.

Financial Reports >> Tax Reports >> GST output Report

- Dues Page – Security Deposit Summary

The total security deposit collected in the society is now available as a summary on the new dues page.

Accounts >> Due and Receipts >> Dues

- Handling Penalty in FD

Previously when the penalty was applied on premature FD, the additional JE entries for it were not associated with the principal transaction. With the current update, we have made the necessary changes under the FD section enabling the journal entries to be shown under General Ledger while applying a penalty over Premature FD.

Additional Notes :

Meter Edit to allow details reset

- Edit meter number should allow the details to be reset.

- DB for the first house will be replaced with blank, allowing correction in the second meter.

Format Issue in Dues Report Download

- The excel file name now contains the name of the report

- The first two rows summarize the society and period information

- Formatting should be changed to number for value cells

Bangalore is one of India’s fastest-growing cities. It has the highest rate of employability and is the top choice for women seeking employment. It takes pleasure in being the city that caters the most to millennials with its business forums, quiet environment, and easy accessibility to a. Upscale apartments are popular in the city. Imagine waking up to the sun’s first rays illuminating one of the nation’s top cityscapes. Bangalore is a beautiful city with world-class amenities and infrastructure.

List of top luxury apartments in Bangalore: based on amenities and building quality

1. Sobha HRC Pristine Luxury Apartments, Jakkuru- Luxury at its best!

Sobha HRC Pristine is a green paradise in north Bengaluru. The luxury apartments in this property have access to clear sky, pure water, and untouched surroundings. Sobha HRC Pristine is located near Kempe Gowda International Airport, international schools, world-class hospitals, IT clusters, and recreational areas. Its newest residential property includes 3- and 4-bedroom luxury flats, penthouses, and rowhouses, making them one of the best flats in Bangalore.

Teak, mango, and silver oak trees beautify Sobha HRC Pristine’s natural landscape, and extra care has been taken to retain its distinctiveness. The apartments offer cool clay cladding, a bio-pond, a flowing stream, bird’s nest coves, and a reflexology walk.

2. Prestige Kingfisher Towers Luxury Apartments, Lavelle Road- Elevated modern luxury

These unique luxury apartments are in Bangalore’s Lavelle Road area. The project overlooks UB City and Cubbon Park, offering stunning views of the city’s most chic neighbourhoods. The 33-storeyed structure has flats starting from the 5th floor. The project features 3 towers—A, B, and C—each with 8,321 sq. ft. 4-bedroom apartments. Each unit of Prestige Kingfisher Towers has its own lift lobby, service lift area, and access to the clubhouse, pool, and gym. It is one of the top apartments in Bangalore to rent or own.

3. Prestige Leela Residences– Stellar amenities at your fingertips!

The ultra-luxury residences in Kodihalli Prestige Leela Residences comprise an upmarket east Bangalore property. Prestige Leela Residences is exquisitely designed to resemble the Mysore Royal Palace. The 3-acre property has 88 units of 4 BHK luxury residences. Indulge in a traditional lifestyle at Prestige Leela—one of the best apartments in Bengaluru!

4. Tata Promont Luxury Apartments, Banashankari- Your urban oasis

The Tata Group, one of the country’s oldest and most renowned business houses, has forayed into real estate under the brand Tata Housing. It has created the Promont atop Banashankari hill, Hosakerehalli in south Bangalore. Tata Promont is one of the best luxury apartments in Bangalore and among south Bangalore’s most iconic residential spaces.

The Promont is one of the most desirable “Hill Residences” in Bangalore, comprising 312 units of 3- and 4-BHK apartments and penthouses spread across 4 storeys. The Promont is a self-contained hamlet spread across 14 acres of lush natural landscape that offers modern pleasures and services and convenient access to the city and other essential locations.

Tata Promont provides numerous ways to break routine. Everything needed to live well can be found here. Enjoy the newest box office successes at the pretty little theatre or relish foreign cuisines without having to commute. The 3-level clubhouse has all this and more to rest, recharge, and entertain. All these features make Tata Promont one of the top apartments in Bengaluru.

5. RMZ Latitude– Lifestyle you deserve!

RMZ Homes’ magnificent creativity in development and architecture is well-known. RMZ Lattitude in Hebbal, Bengaluru, is a premium property. The 3.92-acre home development features green-lined boulevards and gardens. The property has 122 units of 3- and 4-BHK apartments with modern amenities. Rich, stylish decor, and international-standard amenities make RMZ Latitude one of the best apartments in Bangalore for rent and ownership.

6. Embassy One Four Seasons—Upscale living

The Embassy Group is one of the largest realty developers, with 54 million sq. ft. of real estate developments across India, Europe, and East Asia. The group’s ultra-luxury Embassy One Four Seasons caters to affluent clients. It is a 2.96-acre property with 109 ultra-luxurious apartments. The facilities on offer are a’ la carte services, limousine service, butterfly gardens, pools, and saloon services. North Tower contains 1- and 2-BHK apartments and South Tower has 3- and 4-BHK flats. The best apartments in Bangalore for rent or purchase are the 2-BHK luxury properties at Embassy One Four Seasons.

7. Phoenix One– Best luxury apartments in Bangalore west

Phoenix One is truly iconic. International architects Benoy and RSP built this 30-storey skyscraper to please selective clientele. The roughly 17-acre site features a beautifully planted green zone developed by Site Concepts of Singapore. Phoenix One Bangalore West provides vast, expansive apartments overlooking the cityscape comprising 4-bed homes with family and study facilities, 3-bed homes, 2-bed homes with a family room, and penthouses. Phoenix One is yet another property with the best apartments in Bangalore for rent.

A massive central green zone, an internal boulevard, and a 50,000 sq. ft. clubhouse with a temperature-controlled indoor pool, indoor and outdoor Wi-Fi connectivity, a bowling alley, multi-level outdoor pools with jacuzzis, a high-tech gym, fine-dining, and designated outdoor and indoor party areas offer you resort-like living in the city. Phoenix One Bangalore West meticulously integrates luxury, comfort, and lofty design with home automation technology and concierge services.

8. Phoenix Kessaku, Rajajinagar- Epicentre of luxury!

Phoenix Mills Ltd is one of the country’s largest retail-led mixed-use developers, noted for its large-scale developments. Phoenix Kessaku can be counted as the developer’s most popular endeavour following mega-commercial successes. The property is located in Bangalore’s Rajajinagar area. The premium home property is modelled on a Zen sphere and Far East architecture with 110 units in 5 towers named Zora, Niwa, Mizu, Faia, and Zefa. It has an infinity pool, garden, mini theatre, and more. It is among the best apartments in Bangalore for rent.

9. Karle Zenith Residences- Spacious modern living!

Karle Infra is noted for its architecture and planning. Bangalore, Mysore, and Goa residents may be familiar with this developer. Karle Zenith is one of the top luxury apartments in Bangalore, combining high culture and a premium lifestyle. The project boasts several first-rate amenities. This 4-acre property has 396 units of 3- and 4-BHK apartments that are among the best flats in Bangalore.

10. Total Environment Windmills of Your Mind– Experience the lifestyle!

The residential development “Total Environment Windmills of Your Mind” is probably the most aesthetically pleasing luxury apartment property in Bangalore. The developer’s architectural style is well-known for incorporating natural features. Total Environment Windmills of Your Mind combines luxury and calm. It is located in Whitefield, East Bangalore, and is a 24-acre premium residential project with 4-BHK simplex, duplex, and triplex residences and villas. Beautiful gardens, a water zone, and a courtyard make it one of the top apartments in Bangalore.

11. Sobha Indraprastha– Luxury, location, and convenience!

Sobha Limited is a reputable developer known for its sustainable urban development strategy. Sobha Indraprastha is in Rajajinagar, West Bangalore, and comprises a 37-storey tower with state-of-the-art facilities. Spread over 9.37 acres, the property has 356 luxurious 3- and 4-BHK homes and offers the best luxury apartments in Bangalore.

12. Salarpuria Sattva Luxuria– Style reimagined!

The Salarpuria Sattva Group is a trusted brand. It has come up with a luxurious apartment development in Malleshwaram, West Bangalore. The property is popular for its well-crafted concrete and glass architecture. This luxury complex has 197 units of 4-BHK flats for rent and ownership. It’s one of the best apartments in Bangalore for rent.

Who doesn’t desire a lovely home in an affluent city? These towers are perfect for a luxurious and relaxing house. They are right in the heart of the nation’s IT hub, which makes them much more appealing! Now, it remains to be seen which among these best luxury apartments in Bangalore has piqued the reader’s interest!

There is no shortage of options for purchasing luxury apartments in Chennai in 2026. The Chennai property market is flooded with luxury developments across locations, making it tough to choose.

If you are looking for the best apartments in Chennai that offer class and luxury, here is a list of the top 10 apartments.

1. Casagrand Olympus

The Casagrand Olympus is a high-end project in Mandaveli, Teynampet, with easy access to important roads such as the St Mary Road. The project is spread over an area of 0.49 acres. Developed by Casagrand, one of the city’s most experienced, the project is now midway through to completion.

Notable features:

- Only two apartments on each floor.

- All units have ventilation from three sides.

- Breathtaking views of the sea and the Adyar river.

- Italian marble was used in making the foyer, living room, lounge, and dining room.

Amenities:

- Gymnasium

- Power backup

- Indoor games

- Elevators

2. Ozone The Gardenia

Ozone, The Gardenia offers premium apartments in Chennai. The location is well-connected by main roads such as the Chennai Bypass Expressway, Poonamallee High Road, and Konnur High Road. Ozone The Gardenia occupies a total of one acre of land. As the name suggests, the project is built by Ozone, a well-known developer in Chennai. It consists of 32 units, with the 4-BHK apartment units priced at INR 6.50 Cr, measuring 3640 square feet in size.

Notable features:

- RCC substructure is supported by a pile foundation.

- Lift lobby – Marble or equivalent wall covering.

- Green walls, foam concrete, glass, and louvres as exterior finishes.

- Lobby false ceiling made of gypsum.

Amenities:

- Swimming pool

- Gymnasium and sauna

- Kids’ play areas/sandpits

- Power backup

- Rainwater harvesting

- Clubhouse

- Indoor games

3. E-Residences

E Residences is a premium residential development located on Club House Road in Anna Salai, Chennai, next to the Express Avenue Mall in Royapettah. The property is situated in the centre of the city and consists of 5 striking towers that house 153 Uber Luxury air-conditioned apartments, with sizes ranging from 3000 square feet to 6500 square feet.

Notable features:

- 330 degree ventilation & expansive balconies

- 5 eye-catching towers on a 5 acre estate

Amenities:

- Swimming pool and toddlers pool

- Gymnasium and sauna

- Children’s play area

- Power backup

- Coffee shop

- Health club

- Indoor games

- Multipurpose hall

- Courts for badminton and tennis, etc.

4. Olympia Sky Villas

Olympia Sky Villas, located in Navallur, is an exceptional project created by Olympia. The 4-BHK apartment units, priced around INR 5.00 Cr, are the Jewels in the crown of Olympia Sky Villas. The location is easily accessible by major roads like the East Coast Road, State Highway SH 49, and the OMR Road. Besides world-class facilities, there are 18 units in the project currently which are all ready to move.

Notable features:

- Plunge pool and home automation in every unit.

- 18 premium duplexes with one exclusive entrance per floor.

- Living, drawing, and dining areas with imported marble flooring and bedrooms with designer wooden flooring.

Amenities:

- Gymnasium

- Café/Coffee bar

- High-speed elevators

- Reading room/library

- Conference room

5. Olympia-Park Residence

Located at the heart of Kotturpuram, one of the most affluent and posh neighbourhoods in Chennai, Park Residence – By Olympia covers an area of one-acre-plus land. A brilliant specimen of architectural brilliance, this project has on offer some of the best luxury apartments in Chennai. The 3-BHK units are priced at INR 6.64 Cr and occupy an area of 2766 square feet. The 4 BHK flats, on the other hand, are priced between INR 7.99 Cr and INR 12.33 Cr.

Notable features:

- A total of 31 residences spread over three floors.

- Reinforced concrete structure.

Amenities:

- Swimming pool

- Gym

- Party lounge

- Landscaped terrace

- Power backup

- Clubhouse

6. Kalpataru One Crest

One Crest project, located in Nungambakkam, Chennai, has been built by Kalpataru Limited, an award-winning real estate company. The project boasts a tower with AC duplexes and a grand entrance lobby. The 11-feet-high ceiling, designed to allow natural light in, is truly spectacular. In addition, the project includes a total of 43 units. The spacious 4-BHK apartment units are valued at INR 9.5 Cr and occupy 3800 square feet. The 5BHK+5 Units, with a size of 5777 square feet, are priced at INR 14.44 Cr.

Notable features:

- Marble flooring.

- 100% Vastu-compliant project.

- Stretched out sundecks.

Amenities:

- Swimming pool

- Gymnasium

- Aerobics/Yoga room

- Elevators

- Intercom facility

- Jacuzzi

- Power backup

- Landscaped gardens

- Community centre

- Rainwater harvesting

7. Akshaya Homes Abov

Akshaya Homes is a well-planned and intelligently built residential complex in Chennai’s Maraimalai Nagar neighbourhood. The project combines attractive designs and contemporary architecture with well-ventilated and spacious apartments. The 4-BHK apartments range in size between 6000 and 6514 square feet. Furthermore, the unit size of the 5-BHK apartments is roughly 10887 square feet.

Notable features:

- A total of 31 residences spread over three floors.

- Reinforced concrete structure.

Amenities:

- Swimming Pool

- Spa

- Aerobics room

- Squash and tennis courts

- Cycling and jogging tracks

- Clubhouse

- Indoor games

8. TVH Quadrant

TVH Quadrant, a beautiful project created by the Chennai-based TVH, covers an area of 2.5 acres. The project is located in Shastri Nagar, Adyar and is well-connected by roads such as Kalki Krishnamurthy Road, Durgabai Deshmukh Road, and Anna Salai Mount Road. There are 126 units in the project; out of these, the 3-BHK apartments are available for INR 4.36 Cr with property sizes ranging from 2235 square feet to 3260 square feet. The property also offers spacious 4-BHK apartments, between 3595 square feet and 3615 square feet in size. If you are looking for High Rise Apartments In Chennai with a spectacular view, you now know where to look!

Notable features:

- Italian marble floors.

- Decks with floor-to-ceiling windows and imported fittings.

Amenities:

- Gymnasium

- Power backup

- Swimming Pool

- Home automation

- Spa

- Clubhouse

- Indoor games

9. Arihant Housing Jashn

Arihant Housing Jashn is a magnificent project built by Arihant Foundation, a renowned developer in Chennai. The project is located near Egmore, Royapuram and is well-connected by important roads. Offering some of the most premium apartments in Chennai, there are, in total, eight units, all of them marked ready to move. For those interested in buying a high rise apartment in Chennai, it is advisable to go for the 3-BHK apartments, covering an area between 2750 square feet to 2850 square feet each. Priced in the range of INR 4.13 Cr to INR 4.35 Cr, the apartments will offer complete value for money.

Notable features:

- Beautiful landscape and residences that are naturally ventilated and space optimised units.

- Four storeys holding eight big flats.

Amenities:

- Gymnasium

- Swimming Pool

- Intercom

- Kids’ play areas / sandpits

- Clubhouse

- Rain water harvesting

10. Brigade Residences

Brigade Group, one of India’s premier property developers, is the force behind the Brigade Residencies project, offering some of the most ultra-luxury apartments In Chennai. It is conveniently located on Chennai’s IT corridor, in Perungudi. This well-known Chennai property is an integrated neighbourhood featuring residential, commercial, and hospitality spaces. Each one is built to the greatest international standards.

Notable features:

- Besides two 26-story towers, there are 298 podium-level 3-bedroom residences and 4-bedroom penthouses.

- Endless sea views to the east and lake to the west.

Amenities:

- Gymnasium

- Swimming Pool

- Courts for tennis, squash, and badminton

- Regular library

- Mini theatre

- Spa & salon

- Kids’ play areas/sandpits

- Clubhouse

- Indoor games

- Multipurpose hall, etc.

We hope this blog will help you in finding the best luxury apartment in Chennai to buy or rent.

About MyGate

MyGate is India’s largest society management system, benefiting thousands of housing societies, developers, society facility managers, and millions of homeowners in every Indian city.

Neighbourhood