As society approaches an age of progressive thinking with increased emphasis on individual freedom, more single parents are considering being homeowners and fortunately enough, it’s become easier than before for working parents to buy a property whether they’re a single mother or a father. According to a report by the UN, roughly “4.5% of all Indian households are run by single mothers.” A single parent buying a house has to be extra cautious as the entire responsibility of the home buying process (no matter with help from family and friends), is still befalling a lone pair of shoulders.

Let’s explore some critical perspectives.

Get your finances in order

If you have the following, you can be an eligible single parent candidate for a home loan:

- A regular source of income upon which a loan can be granted along with good credit ratings.

- (Or a stable business/self-employment).

- Single mothers qualify if their age at the time of sanction is between 18-70.

- Possess the required documents such as –

- PAN CARD, AADHAR Card, completed loan application

- Govt issued ID proofs such as driver’s license, voter ID, passport

- Residential proof like electricity and utilities bills, bank account statements, other relevant documents like birth certificates, etc.

- Declaration and proof of personal assets, collateral

However, you’d have to create savings to make the down payment.

Financial tips for single parents before buying a home

Invest in a child education plan (with professional consulting) so that the child’s educational benefits are guaranteed even during potential unstable financial conditions. Make sure the insurance cover increases over years based on the number of children you have.

Consider investing in security and wealth baskets monitored by professionals and choosing to spread your investments in different SIPs/equity funds. If your savings are limited, you can try different low-yield insurance policies as well.

Figuring out the priorities of what you need from the property

As a parent, you’d need to live where your child has access to good schools, public transport, cultural spots, and other factors according to your lifestyle. You’d also need to consider the apartment’s location (which floor, how many bedrooms, bathrooms, and other amenities that you might expect in the housing societies like a nursery, gym, swimming pool, tennis courtyard, and others).

Other points to consider are the distance from home to school, especially when residing in urban cities where the commute is a factor and the availability of immediate medical care/clinics around the house.

If you’re taking a home loan, it’s wise to keep the installment at around 30% of your total salary so that you can live comfortably with the remaining amount and be able to save.

Learn – How Home loans help you save on income tax

Look for a stable and welcoming community

Whether you’re widowed, divorced, or separated, you’d need to surround yourself with a support system that not just includes family and friends, but also neighbors and community. As the adage goes, ‘it takes a village to raise a child’. The housing community where you decide to live should have supportive and understanding neighbors. If a society has an end to end security and society management app like MyGate, it’s great news for single parents as it works on a passcode verification system of gatekeeping so that the premises are completely safe and child safety protocol, where a child is not allowed to leave the premises unaccompanied without prior permission from the parent.

Does the house have a good resale value?

As a single parent, do not be pressured to buy a property without a future potential even though it may come cheap. You need to factor in the market value of the property, its location, its size, proximity to public utilities, shopping malls, etc, and get a professional appraisal done in case you’re not buying a brand new home.

Look for grants and aids

As a single mother, you can avail the benefits of low-interest rates on home loans from nationalised banks like SBI and others. Some states may even provide exemption on stamp duty and registration charges, sale deeds, conveyance deeds if the buyer is a woman. Under the Pradhan Mantri Awas Yojana, if you’re a (single parent included) household with an annual income between Rs 6 lakh and Rs 12 lakh fall under MIG (middle income groups) I while households with an annual income between Rs 12 lakh and Rs 18 lakh fall under MIG II category hence you’re eligible for interest subsidies of 4% and 3% on loan amount up to Rs 9 lakh and Rs 12 lakh (MIG I and MIG II categories only). More details.

It is recommended that as a single parent without prior experience in property purchase, you should hire a reliable estate agent who can help you navigate through the entire proceedings with expert guidance.

India’s elderly citizen population is growing at 3% annually and is estimated to reach around 319 million in 2050. With a shift towards nuclear family and dismantling of the traditional joint family system, more senior citizens are considering living independently post-retirement. Age is not a factor when it comes to buying property even nearing retirement, however, it’s always wise to know the implications and technicalities of property purchase in any case so that you’re aware of what applies to senior citizens specifically.

What are the features of senior citizen /retirement community living?

- The concept has now taken off in India as we see many retirement community homes being launched by a handful of builders who are the first movers.

- Senior living means living in a community of residents above the age of 55 who may or may not be still actively working.

- The establishment has senior-citizen-friendly features like safe premises, housekeeping services, emergency health care services, and medical assistance.

- The design features that make living easier also include wide hallways with flat passageways to accommodate wheelchair access, skid-free floors, continuous grab rails, etc.

- There are amenities and facilities for recreational and group activities, along with concierge services that assist with paperwork, bill payments, hiring on-demand services, lounges, clubhouse, laundry, and cafe services.

What is the price range?

Usually, retirement homes are available in low income (Rs 10-20 lakh), middle-income range (Rs 25-50 lakh), and above. The top cities to look for a retirement home are Lavasa near Pune, Bhiwandi on NH8 in Rajasthan, Jaipur, Chennai, Delhi/NCR, Goa, Puducherry, and Coimbatore.

Factors to consider before buying property as a senior citizen

1. How old is the buyer?

If you already post 70 years of age or younger but are not in the prime of your health, you might want to choose a retirement home that can take care of you 24/7. However, if you are independent enough and can take care of your basic needs, you can own property in regular housing societies as well. Senior citizens are usually well taken care of by friendly neighbors and good samaritans if you scout the community beforehand to make sure that the neighbours are congenial.

2. Availability of healthcare & infrastructure

It’s the age of telemedicine consultation and on-demand medical services (like blood test, thyroid test) delivery reports which can be received at home. It’s also preferable to look for property that is located close to clinics and hospitals in case of emergency health services. There should be access to roads and cabs.

3. Peaceful surroundings

Elderly citizens like to enjoy their peace and quiet and may not enjoy living in a community with hyperactive kids and loud get-togethers occurring frequently. In such cases, you can opt for a property situated on the outskirts of the city or an apartment location that can provide heightened privacy.

4. Complex amenities

It’s always a preferred option for senior citizens to occupy a home on the lower floors, or else the apartment complex should have elevators, along with CCTV surveillance with security guards trained in fire safety and first aid. Another feature to seek is safety handlebars installed in bathrooms, balconies and no unnecessary complicated furniture/application customisation inside the apartment should be allowed. Many retirement communities have tie-ups with nearby health facilities, ambulances for cashless treatments.

5. Financial planning

It’s commonly known that senior citizens above 50 may not get a housing loan from a lending bank as easily as a working professional, however, with proper financial planning, owning a property in your golden years is achievable.

If you’re receiving a regular pension, getting a home loan is easier. In most cases, banks offer home loans to senior citizens for maximum repayment duration of 15-20 years or up until they turn 70-75 years of age, whichever comes first and the EMI is set accordingly. Banks like SBI, PNB, LIC (and other leading national banks) offer home loans to senior citizens starting from Rs 5 lakh to Rs 25 lakh (others can go even higher).

Senior citizens can even choose to invest in a property and rent it out to earn 5-10% of the total price.

An important factor to consider is Loan To Value Ratio. For instance, if the total price of the house is Rs 10 lakh and you’re making a down payment of Rs 1 lakh, you’re actually borrowing Rs 9 lakh, so the LTV is 90%. Choose a loan with a low LTV ratio so that the EMI is not too high every month.

6. Cultural phenomenon

Retirement Community Living is a growing trend among city dwellers and it reduces the impact of loneliness among elderly residents as they are well occupied throughout the day. Premium retirement homes in urban areas provide acres of land for leisurely lifestyle and pursuit of hobbies among various high-end amenities like mini-golf courses and outpatient clinics.

All in all, investing in a property in your elder years is a step in the right direction if planned correctly in advance with the help of family, friends, or even professional realtors.

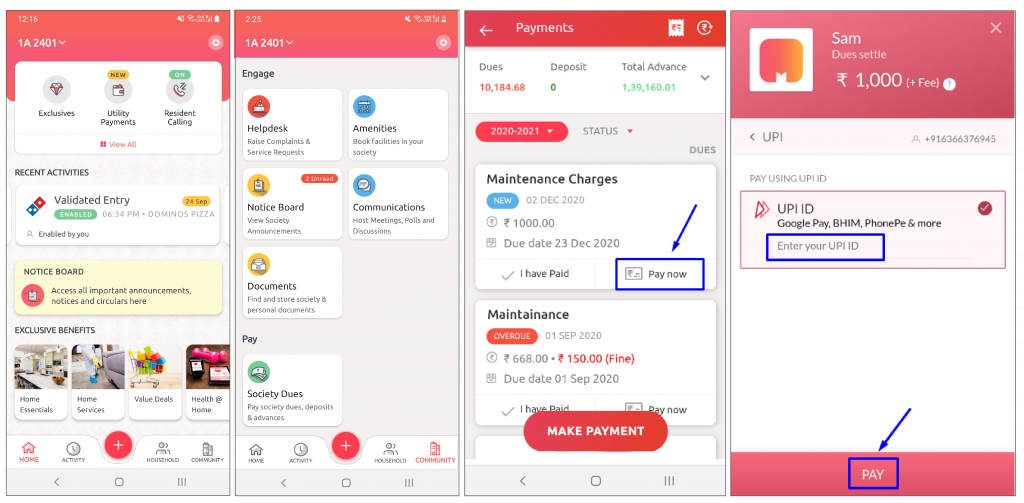

Paying your society charges, and keeping track of past payments, can be a hassle. MyGate puts an end to these problems by offering a quick and easy way to pay and manage your charges via the app. Also, stand a chance to win amazing cashback and boost your household savings every month.

Pay NowBenefits of paying on MyGate

- Home savings with exciting monthly cashback and bank offers

- Contactless one-click digital society charges payment

- View charges by date, month, and year on the dashboard

- Download receipts of paid chargess and other society bills

- Pay via credit cards, debit cards, UPI, or e-wallet options

- Payments will be acknowledged via SMS/Email

- Access entire transaction history in a single place

- Get updates on the current status of your payment

- Connect with MyGate support for payment related queries

- NRI Customers can transfer funds at the domestic rate for Credit Cards

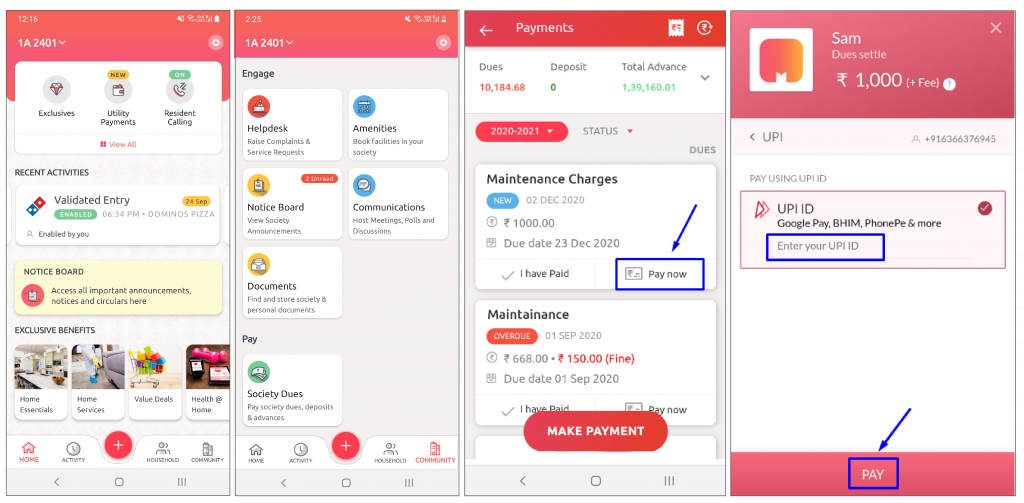

Here’s how you can pay…

1. Tap on the ‘Community’ tab

2. Click on the ‘Society Charges’ card

3. Click on ‘Pay Now’ on the invoice raised

4. Select the mode of transaction – UPI, Debit/Credit Card, Net Banking, Wallet and click on ‘Checkout’

5. Enter the details and click on ‘Pay’ STEP-5

– For UPI, enter the UPI ID For Debit/Credit Card, enter the card details

– For Net Banking, select the bank and login

– For wallet, select the wallet and login

6. The convenience charges are displayed on the screen. Click on ‘Continue’ to make the payment

You can now avail of cashback benefits even if your society is not using MyGate ERP package. Learn more.

Benefits for the Management Committee:

- Avoid manual receipt entry for payment collection

- Ensure zero physical interaction between residents & society office

- Avoid the hurdle of cheque deposit & clearance, save time and effort

- Effectively manage collection from residents

- Save bank interest while dealing with cash & cheque

- Flat numbers in the society bank statements simplify the reconciliation process and save time during auditing.

- Helps aggregate category-based payments to selected bank accounts

- Avoid confusion & complications around collection date & late fee

- Reduces the dependency with accountants, which saves cost & ensures transparency

- Saves cost during yearly auditing

What’s new on MyGate

Your house rent is probably one of the biggest spends you make in a month. You may not have the liberty to skip paying the amount since it’s essential to make timely rent payments. This is why Mygate has introduced RentPay on the app. You can now pay your house rent via Credit Cards and get exciting monthly Credit Card rewards and 0% fee via UPI & Rupay Debit cards.

Pay NowWhy pay your rent using Mygate?

- Home savings with exciting monthly cashback and bank offers

- Free up cash and get a 45 to 60-day interest-free credit period

- Enjoy the lowest transaction charges on payments via credit cards

- Make UPI payments at zero transaction cost

- Set reminders so you never miss a due date

- Manage all your household payments in one place

- Download rent receipts to claim maximum HRA tax benefits

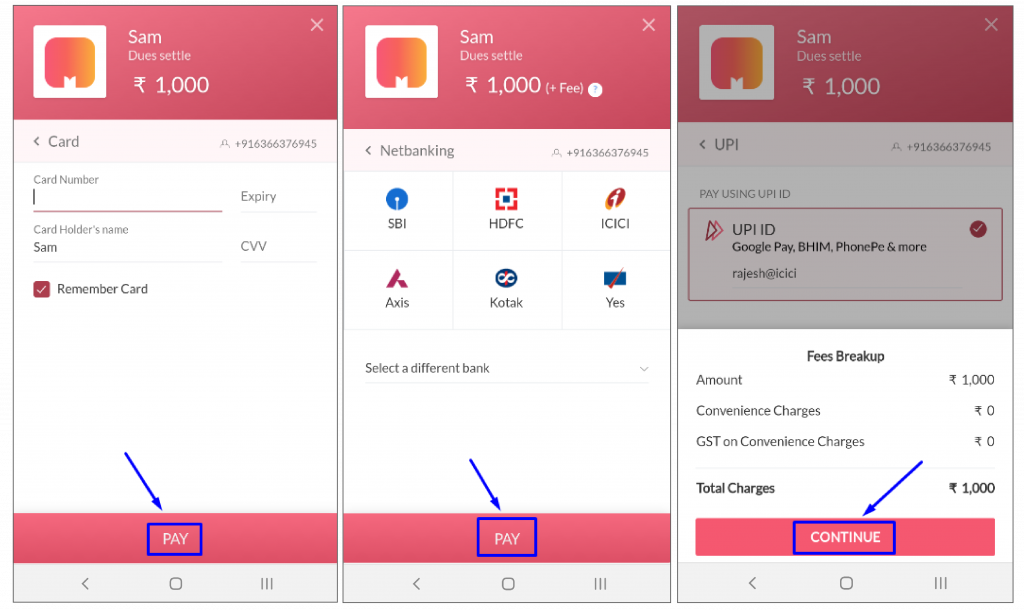

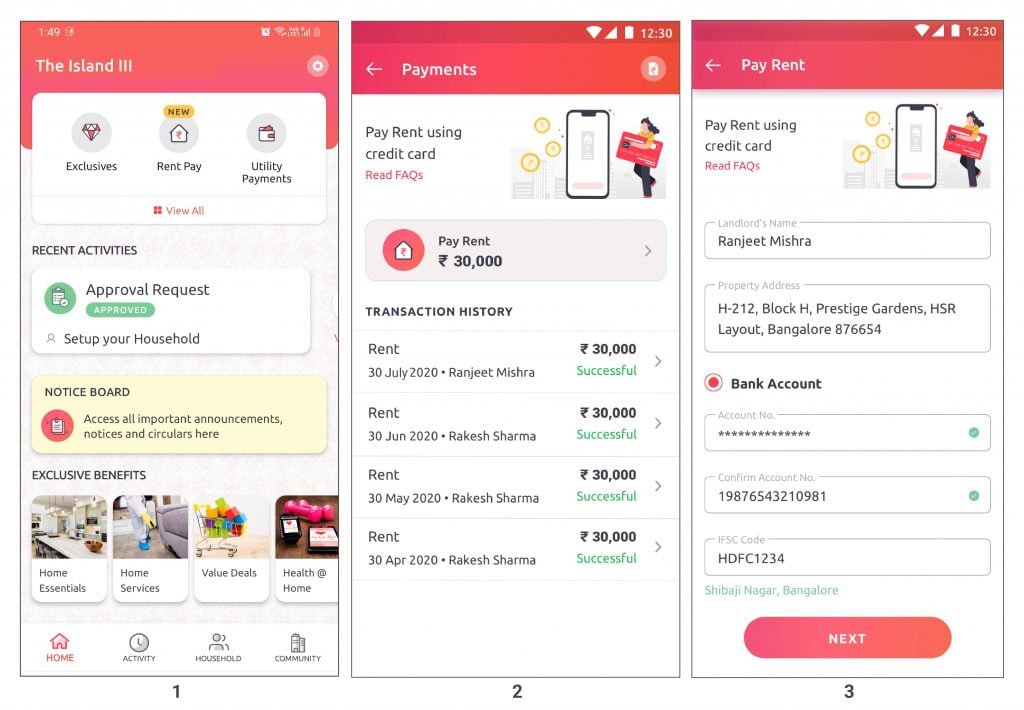

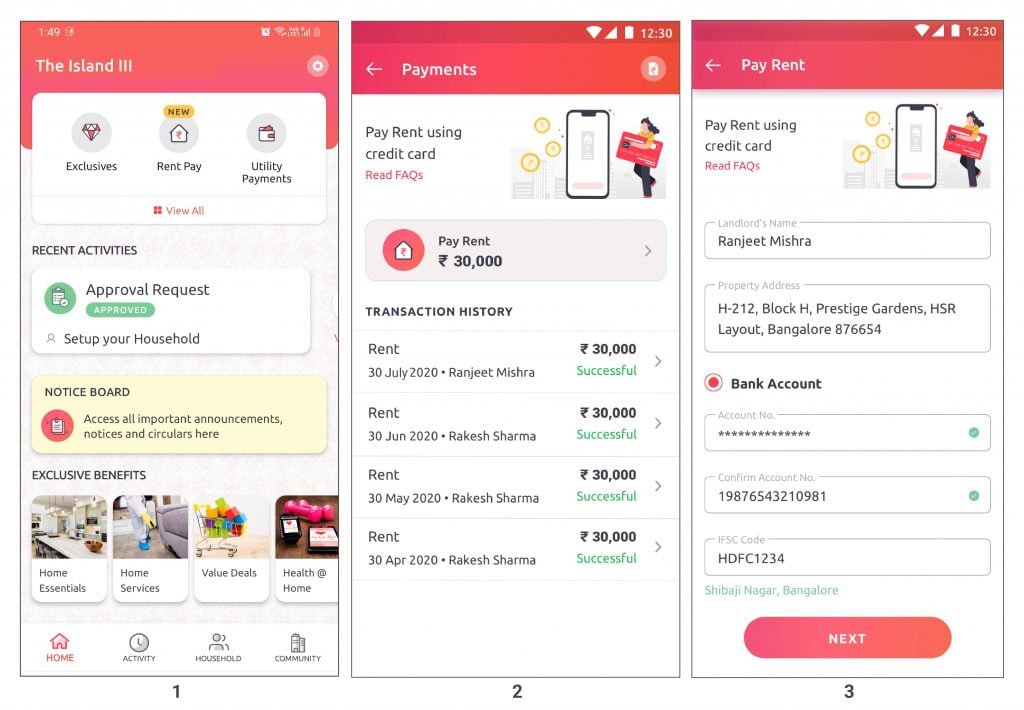

Here’s how you can get started….

1. Click on the Rent Payment widget on the app

2. Click on ‘Pay Rent’

3. Add the Landlord’s name, the property address, the Landlord’s Bank account details and click on ‘Next’

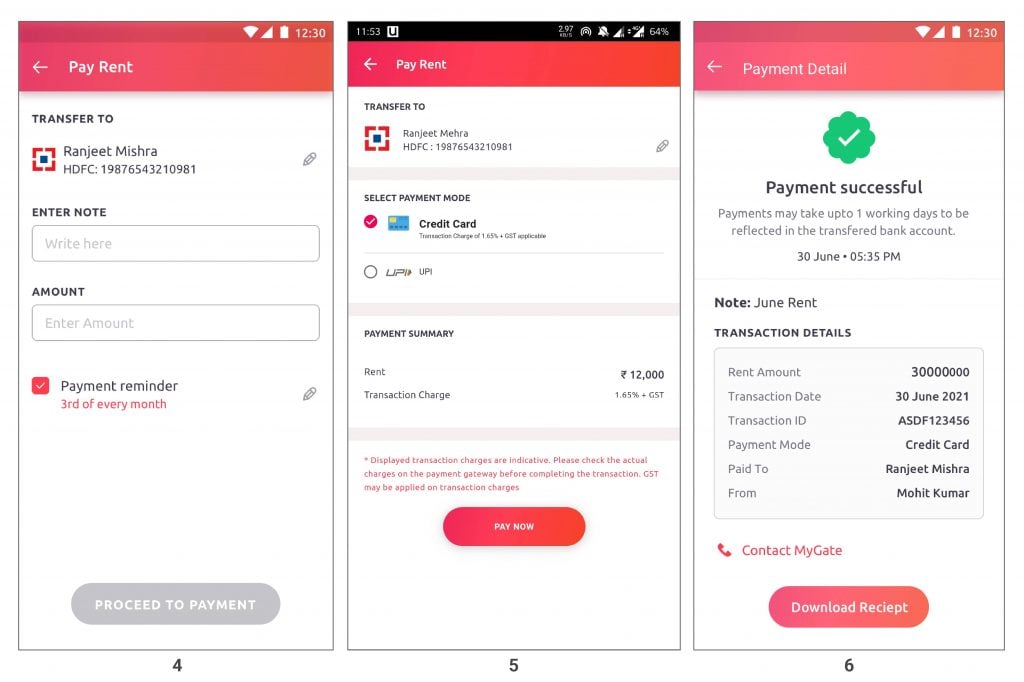

4. Add a note, enter the amount that has to be paid. You can check ‘Payment reminder’ and edit the date. Click on ‘Proceed to Payment’

5. Select the payment mode and click on ‘Pay now’

– For UPI, enter the UPI ID

– For Debit/Credit Card, enter the card details

6. View the payment status and download the receipt

For more details please contact your management committee.

It’s the start of the month, there are a lot of bills to settle, and domestic staff salaries to pay. The process is equally scattered across cash, cards, notes, and reminders as much as it is scattered in your head. But not anymore, thanks to MyGate Payments – a quick and easy way to pay and manage your home and community bills via a single app, with INR 4 charges for payments via UPI, and to also enjoy cashback and Credit Card offers every month.

Why MyGate Payments?

- Exciting cashback, rewards, and bank offers every month

- Pay and manage home & community bills in a single place

- Pay rent using a credit card & get an interest-free credit period*

- Options to pay securely via credit cards, debit cards, UPI, or e-wallets

- Transaction history of all your utility payments

- Download receipts of paid charges and society bills

- Payments acknowledged via SMS/Email

- Updates on the current status of your payment

- MyGate support for payment related queries

Let’s get started…

A. How to pay for your house rent

1. Click on the Rent Payment widget on the app

2. Click on ‘Pay Rent’

3. Add the Landlord’s name, the property address, the Landlord’s Bank account details and click on ‘Next’

4. Add a note, enter the amount that has to be paid. You can check ‘Payment reminder’ and edit the date. Click on ‘Proceed to Payment’

5. Select the payment mode and click on ‘Pay now’

– For UPI, select the preferred UPI app

– For Credit Card, enter the card details

6. View the payment status and download the receipt

Enjoy 0% fee via UPI on your house rent. Pay Now!

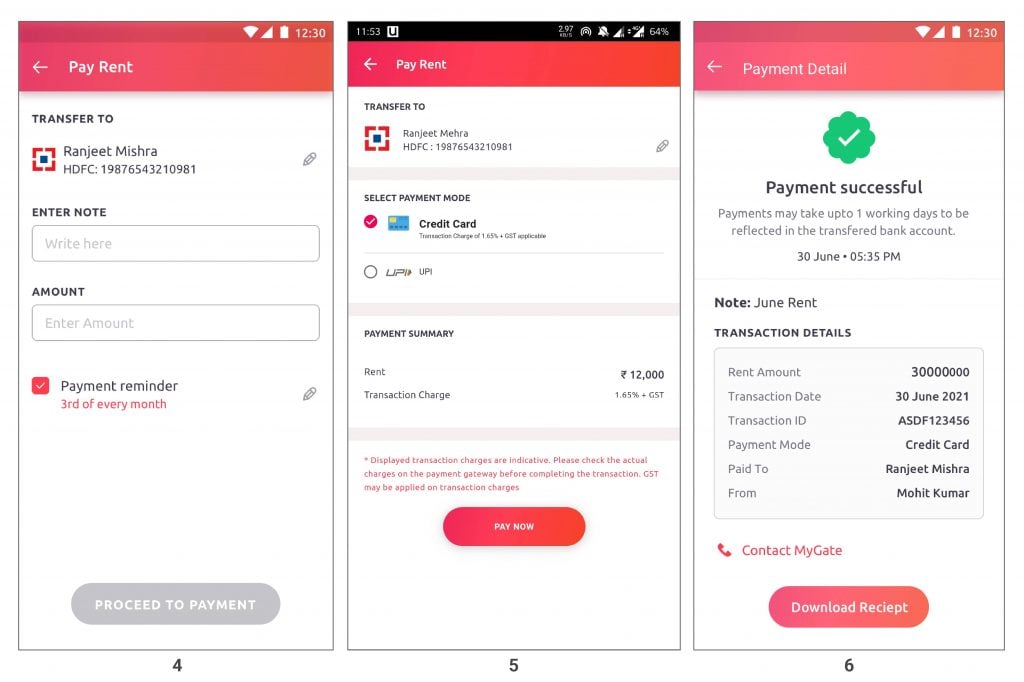

B. How to pay your society dues

1. Click on ‘Society Dues’ under the Community tab

2. Click on ‘Pay Now’ on the invoice raised

3. Select the mode of transaction – UPI, Debit/Credit Card, Net Banking, Wallet and click on ‘Checkout’

4. Enter the details and click on ‘Pay’ STEP-5

– For UPI, select the preferred UPI app

– For Net Banking, select the bank and login

– For wallet, select the wallet and login

5. The convenience charges are displayed on the screen. Click on ‘Continue’ to make the payment

Watch the video below for a complete walkthrough…

Enjoy SBI Credit Card & MobiKwik offer on your July society charges. Pay Now!

MyGate’s ERP Package is an end-to-end community management system that comes with a number of other useful features including quick access to essentials, healthcare at home, digital society updates, and emergency alerts in case of crisis. To enable it, contact your management committee or MyGate relationship manager.

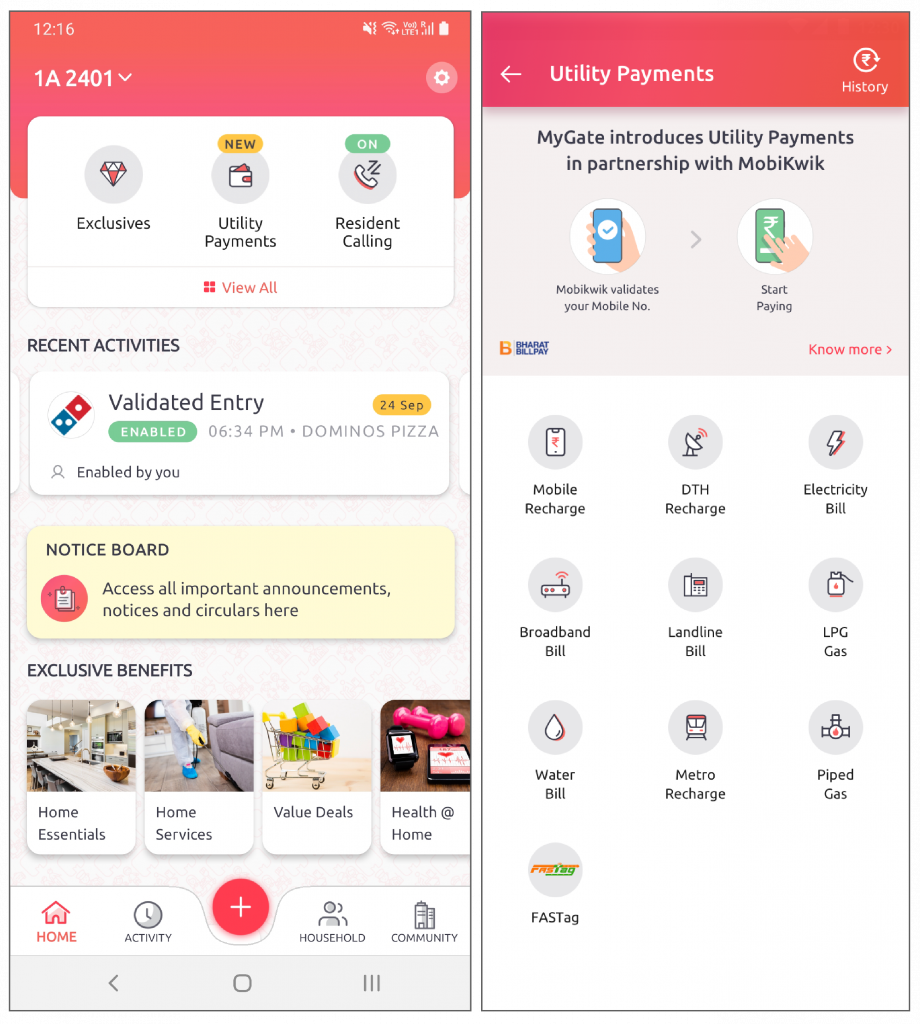

C. How to pay for your utility bills

1. Click on the Utility widget on the app

2. Sign up and validate your mobile number

3. Select the payment you want to make – mobile, DTH, Electricity, Gas, or others – and proceed. You will remain signed in to the ‘Utility Payments’ section for 90 days.

4. Post 90 days, validate your mobile number again with OTP for security reasons

5. Transaction History for all the Utility Payments is available in the top right corner

Open the app link to pay your bills today!

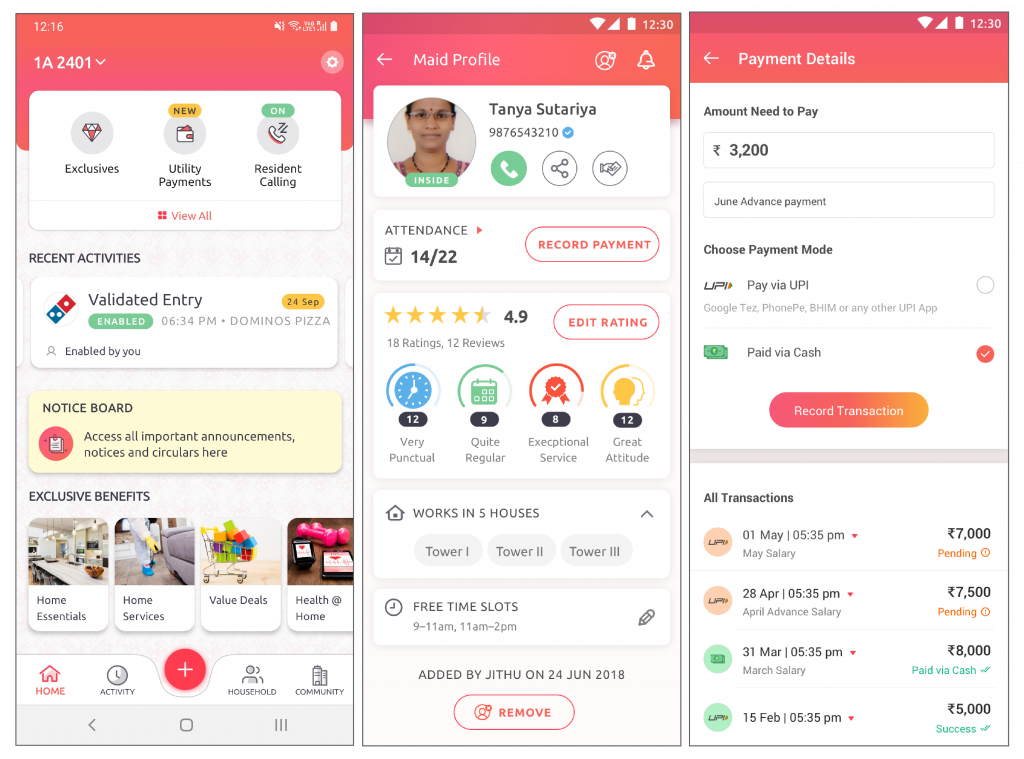

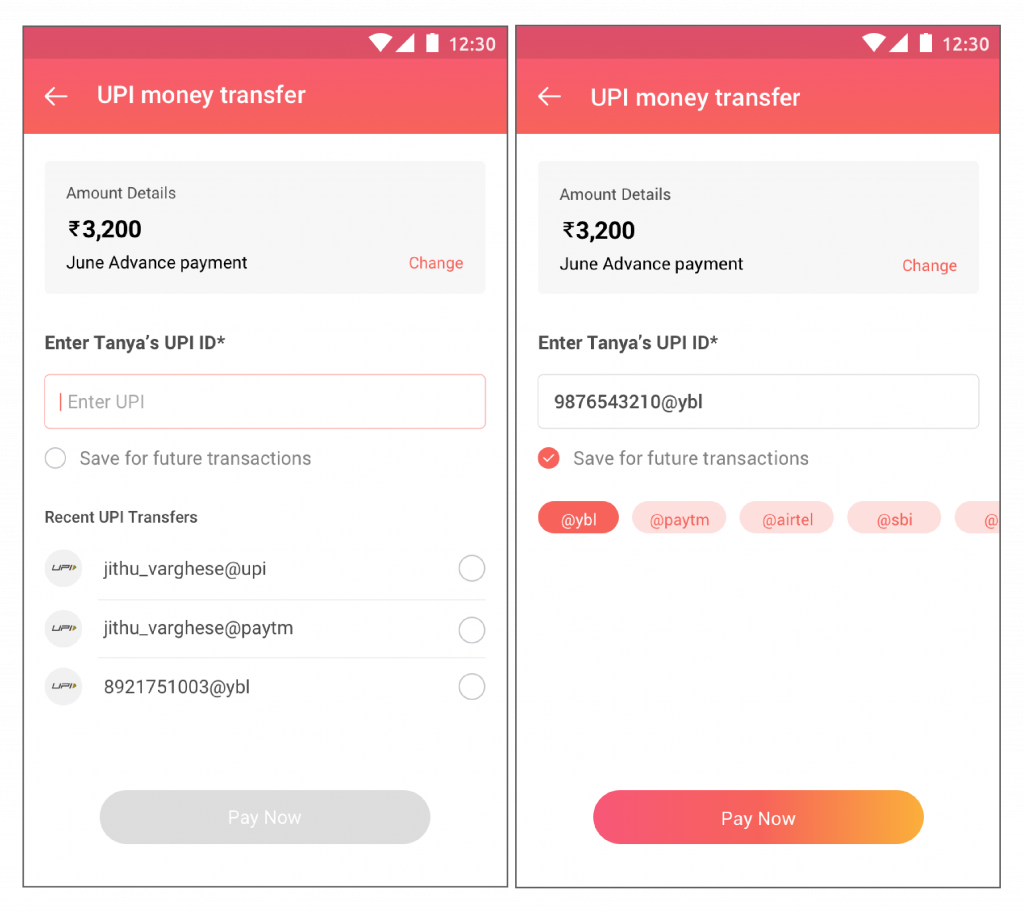

D. How to pay your domestic help salaries

1. Select the ‘Household’ tab on the app home screen

2. Got to your domestic help’s profile and hit the ‘RECORD PAYMENT’ button

3. Enter the amount to be paid and the transaction description

4. Choose payment mode as UPI

5. Click on ‘Proceed to Payment’

Get started with MyGate today and unlock the convenience of one-click payments! Get in touch with your society admin for details.

*Interest-free credit period is different for all banks.

What’s new on MyGate

Ramadan (Eid al-Fitr) also called the “Festival of Breaking the Fast”, is the ninth month of the Islamic calendar, observed by the followers of Islam worldwide as a month of fasting (sawm), prayer, reflection and community bonding. The period of Ramadan is a profound time for individuals of Islamic confidence. During this holy month, individuals fast during the day, starting before sunrise and breaking it only after sunset. The 30 days of abstaining ends with the celebration of Eid-ul-Fitr.

Ramadan, the blessed puts great significance on togetherness and this plays a big part in the feasts prepared to break the fast, usually attended by a large number of family members and friends. The Iftaar or breaking one’s fast is a joint undertaking that is held in mosques or homes or social areas. During such a time, society must come together to show their spirit of togetherness – a great way to do this could be organising an Iftaar party for the members of the community in your apartment.

Do’s and Don’ts of Organizing Ramadan feast in your apartment Community

Anyone living in a housing society can take the lead in organising the Iftaar as Ramadan is a festival that celebrates solidarity and love among individuals. The feast can be organised in any public gathering space in your apartment – the clubhouse, the playground or the lawn after obtaining the required permissions from the management committee. Members of any faith can take an active part in the festivities. There are however some do’s and don’ts that make organizing this affair much easier. To start with, it is advisable to discuss the celebration with the neighbours and decide on a suitable time and date that is convenient for all.

Do’s

- Decorate society: Transform your society with bold and vibrant colours to celebrate Ramadan and welcome Eid-Al-Fitr. The entire complex can be decorated using Heena lanterns, hanging streamers and decorative banners.

- Welcome the guests: Meet and greet is the main custom of organising a community feast – this allows you to meet the members of society and build the feeling of community. With a warm wish, welcome the individuals to the event. You could also explain about the festival and the purpose of organising the feast.

- Pray together: Traditionally, a small prayer is said before breaking the fast. Assign a separate space like the amphitheatre, clubhouse, guest rooms for men and women where the individuals in attendance can pray. Arrange enough prayer mats as per your guest counts.

- Break the fast: Traditionally light food items such as dates, milk, water, fruit and starters such as samosas, cutlets etc, are served to the guests, to break the fast. Iftaar menus traditionally include hearty dishes such as biryani, kebabs, soups, gosht and a variety of desserts and non-alcoholic drinks. When deciding on the menu, it is important to ensure that you have plenty of healthy options like salads and fruits and also ample vegetarian and kid-friendly options. Alternatively, you could also organise a potluck or take opinions before deciding on the menu.

- Organize community engagement activities: As a host, you can organise games, discussions and other engagement activities such as watching a film or quizzes to forge togetherness. Ensure that the atmosphere is genial and there are no events that may lead to disagreements.

- Zakat and Fundraising: Zakat is a significant part of Islamic culture. Since Ramadan is all about giving and the community spirit. You can tie up with non-profit organisations to help a charitable cause. Guests must be informed beforehand about the fundraising activities and Zakat, so that they come prepared with their items to donate. You could organise a donation drive where residents can give away garments, food or other items for the needy. Residents could also get together with the apartment association to organise a feast for the poor. You could also ask the guests to donate to the local orphanage, old-age home or a hospital directly.

Don’ts

- Avoid drinking or smoking in public places: Advise your guests to not to drink or smoke in public, which is not ideal in a community setting.

- Avoid playing loud music: Playing loud music may disturb other residents, cause a nuisance or break noise pollution laws.

- Don’t waste the food: Make sure none of the food is wasted. Arrange to donate the leftovers beforehand.

- Don’t engage in any disputes: Make sure the guests do not get into fights, arguments, debates, or engage in abusive language during the celebration.

Celebrating Ramadan in your housing society will help the residents know each other better and allow individuals of different faiths to become familiar with and appreciate the customs of other religions. With care, organisation and the spirit of brotherhood, your community can successfully celebrate this beautiful festival.