If you’re a tenant or a landlord you must have definitely heard of a document called “rent receipt” – written confirmation of a tenant’s payment of rent to a landlord. You must be aware that most of the time, once you have made the payment, you must request a rent receipt containing the name of the tenant, name of the landlord and the rental cost. But have you ever wondered why?

Let’s discuss it in this article,

Why rent receipt is important?

Rent receipts are the documentary proof that you have spent a certain amount from your salary to cover the cost of living in a rental accommodation. It becomes especially important when you’re looking to be exempted from paying house rent allowance (which is typically a part of your salary package). Your employer will need to collect proof of rent payment from you. Your final tax liability will be calculated based on your rent receipts. Your TDS (Tax deducted at source) will also be adjusted so that you don’t have to pay tax on HRA.

What is HRA (House Rent Allowance)?

The HRA rent receipt is the annual tax break provided to employees for the amount they spend on lodging. Your salary will only include the basic salary and dearness allowance (DA) component for the purpose of making an HRA claim.

Employers give their employees a tax break known as the House Rent Allowance (HRA). If a salaried individual rents a home, they are still eligible for an HRA deduction through the HRA rent receipt. They are eligible to receive a portion of the government’s tax relief for lowering their tax obligation. These salaried renters are eligible for tax deductions up to the amount of their eligible rent payments under the HRA exemption section.

Can you claim HRA?

If your home is on rent and HRA is a benefit that is included in your income, then you are eligible to make deductions. Salaried individuals, those who rent housing areI eligible for HRA exemptions under Section 10 (13A) of the IT Act in order to reduce their tax burden. Under Section 80GG of the law, self-employed professionals are eligible for a tax deduction for HRA.

According to Rule 2A of the IT Act of 1962, the minimum HRA tax benefit that can be claimed is the HRA received from the employer, or 50% of the salary for employees living in metro areas (or 40% elsewhere), or the actual rent paid less than 10% of the salary.

Why are rent receipts important to claim HRA?

It is absolutely important that landlords provide their tenants with rent receipts because they serve as the sole documentary proof of the transaction between the two parties. You (the tenant) would need to submit these rent receipts to their employers in order to claim their HRA (housing allowance). In order to receive the tax benefit, the rent you pay must be more than Rs 3,000. Even if the home you own is in a different city but you live in a different city in a rented property, you can still claim the HRA benefit and the tax deductions against the principal amount and the interest on any home loans he or she has availed of.

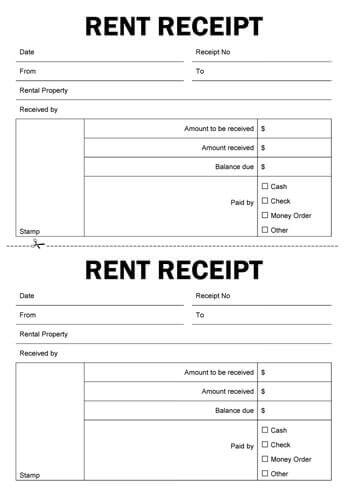

What are the elements in a rent receipt?

The following information is required to make a valid rent receipt for income tax:

- Name of the tenant

- Name of the landlord

- Address of the property

- Rent amount

- Rent period

- Medium of rent payment (cash, cheque, online payment)

- Signature of the landlord

- Signature of the tenant

- Revenue stamp, if the cash payment is more than Rs 5,000 per receipt.

- PAN details of the landlord, if your annual rent payment exceeds Rs 1 lakh or Rs 8,300 monthly

How could you calculate HRA?

The HRA exemption is determined in accordance with Section 2A of the Income Tax Rules. According to Rule 2A, the least of the following is exempt from remuneration under Section 10(13A) and is not taxable income.

- Actual HRA paid by the employer

- 50% of (basic pay + Dearness allowance) for individuals living in major cities

- 40% of (basic salary + Dearness allowance) for persons residing in non-metropolitan areas

- Actual rent paid less 10% of base salary + Dearness allowance

Let’s take an example:

Assume that your monthly salary is Rs 30,000 and that you live in Mumbai and pay a rent of Rs 10,000. An HRA of Rs 15,000 per month is provided by your employer. The tax advantage will be:

HRA = Rs 15,000

Rent paid at 10% of base pay less equals Rs. 10,000 – Rs. 3,000, or Rs. 7,000

50% of basic Equals Rs. 15,000

The HRA will therefore be Rs 7,000, and the remaining Rs 8,000 will be subject to tax

Rent receipt format

How to generate a rent receipt?

There are various online service providers that help you generate rent receipts for income tax without any fee. To obtain a rent receipt, you need to fill in the required information and generate rent receipts. You can generate online receipts by following these easy steps:

Step 1:

Go to the desired platform and click on the rent receipt generator tab. The first page that appears will ask you to provide the tenant’s name and the rent amount. Hit the ‘continue’ button to proceed.

Step 2:

Now provide the landlord’s name, the full address of the rented property, and the landlord’s PAN details (optional). Hit the ‘continue’ button to proceed.

Step 3:

Fill in the period for which receipts have to be generated. Hit the ‘continue’ button to proceed.

Step 4:

You can see a preview of the receipt on the next page. The print button can be used to obtain copies of the rent receipts on the final screen after you have made sure that every aspect of the preview is accurate. The PDF format of your rent receipt is now ready. You can download it on your computer or mobile.